The usual spring busy season has been pushed back this year as many home buyers and sellers delayed their original plans. Mostly due to uncertainty caused by the pandemic. As restrictions gradually lift in parts of the country, data indicates homebuyers will return to many markets.

The usual spring busy season has been pushed back this year as many home buyers and sellers delayed their original plans. Mostly due to uncertainty caused by the pandemic. As restrictions gradually lift in parts of the country, data indicates homebuyers will return to many markets.

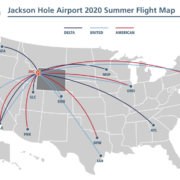

Nationally, Google Trends, which monitors and rates online search terms, reported that searches for the term “real estate” increased from 68 points the week of March 15th to 92 points last week. Supporting that data, our company website, JHREA.com also saw a 134% traffic increase when comparing April 2020 to 2019. This clearly shows that more potential homebuyers are looking to purchase virtually. Fortunately, Jackson Hole Real Estate Associates led the charge early in the pandemic, increasing its virtual resources extensively in response to a fueled interest in real estate in Jackson Hole. We added a virtual open house web page and hosted the first virtual, community wide State of Real Estate forum in the area. With the goal of providing insight to the quickly changing economic climate.

As we continue to work our way to recovery, Jackson Hole Real Estate Associates has been closely tracking the local market to give our clients insight into how the pandemic is impacting real estate in Teton County.

To provide perspective, we are monitoring weekly data from the Teton County Multiple List Service and comparing that data to prior year. The result is real-time knowledge to empower your buying or selling decisions. We are pleased to introduce our new Monthly Market Trend Newsletter.

After a record breaking Q1 2020, with a 29% increase in total dollar volume for Jackson Hole Real Estate Associates, the pandemic uncertainty has played a role in market.

When comparing data from March 1st (when the pandemic started to impact the market) through June 7th 2020 vs. 2019. The Total Dollar Volume is trending positively, 8% higher than the same time period last year. This is due primarily to continued strength in the high–end market with several multi-million dollar sales in the last weeks of May and first week of June 2020.

Another indicator of a robust high-end is a 33% increase in median list price to $2.4M comparing data from March 1st though through June 7th 2020 vs. 2019. Coupling the median sales price increase with a 36% drop in the number of transactions, the numbers do support strength in the high-end segment of the market.

Another indicator of a robust high-end is a 33% increase in median list price to $2.4M comparing data from March 1st though through June 7th 2020 vs. 2019. Coupling the median sales price increase with a 36% drop in the number of transactions, the numbers do support strength in the high-end segment of the market.

New Listing LAG

Uncertainly in the Teton County Real Estate market has impacted new listings overall. Lagging 31% when compared to last year (March 1st though through June 7th). Lack of inventory and perhaps buyer confidence, seems to have impacted the number of properties under contract. Which were down 47% compared to this time last year. Withdrawn listings in the Jackson Hole area increased modestly during this time.

An Increased Demand for Non-City Living. Remote Work Opportunities Up.

A recent Kaiser Family Foundation Study found that 34% of people with jobs said they were working remotely. LinkedIn data shows people in cities hit hard by pandemic in — New York, San Francisco and Seattle — are searching for remote work opportunities significantly more than the rest of the country. Real estate data also suggests many are already considering or making a move to a smaller town. The pandemic is making people reconsider city living, trading congestion for open space.

With a market that has nearly always had a lack of supply, demand does not appear to be waning. According to a recent article by Redfin, interest in real estate in rural areas skyrocketed while interest in cities fell. And while pending home sales are down all over, less populated areas haven’t been hit as hard as large cities, according to Redfin.

It is our continued goal to remain your trusted advisor in real estate. This spring and summer will be an interesting time to watch our local market. Please look for our newsletter next month, as we stay on top of evolving trends.

To learn more or for more information specific to your area, please don’t hesitate to contact us.